Crypto and AI: the hidden digital gray market of Xianyu

Source: TechFlow (Shenchao)

Searching for “USDT” on Xianyu returns a blank page. Change the keyword to “selling USD coins,” and a hidden digital black market instantly unfolds.

Sellers use homophones, coded language, and images to evade platform moderation. “If you know, you know” is the local password. Some hide contact details in the corners of images; others post screenshots of exchange logos to signal they are “insiders.”

Crypto assets—highly sensitive and tightly restricted in public discourse—have not disappeared. They have been disguised and folded into a more down-market platform.

“Buying and selling USDT,” “step-by-step exchange app setup,” “overseas IDs for exchange KYC,” “Binance Alpha tutorials”—here, you can purchase what looks like a one-stop shop for crypto trading guidance.

The digital black market extends far beyond crypto: discounted flights, hotel bookings, hard-to-get restaurant reservations, front-row concert tickets, and even “GI AI verification.”

A common line circulating on social media captures it succinctly:

“You can buy almost anything on Xianyu.”

This is hardly an exaggeration.

The Hidden Crypto Trade

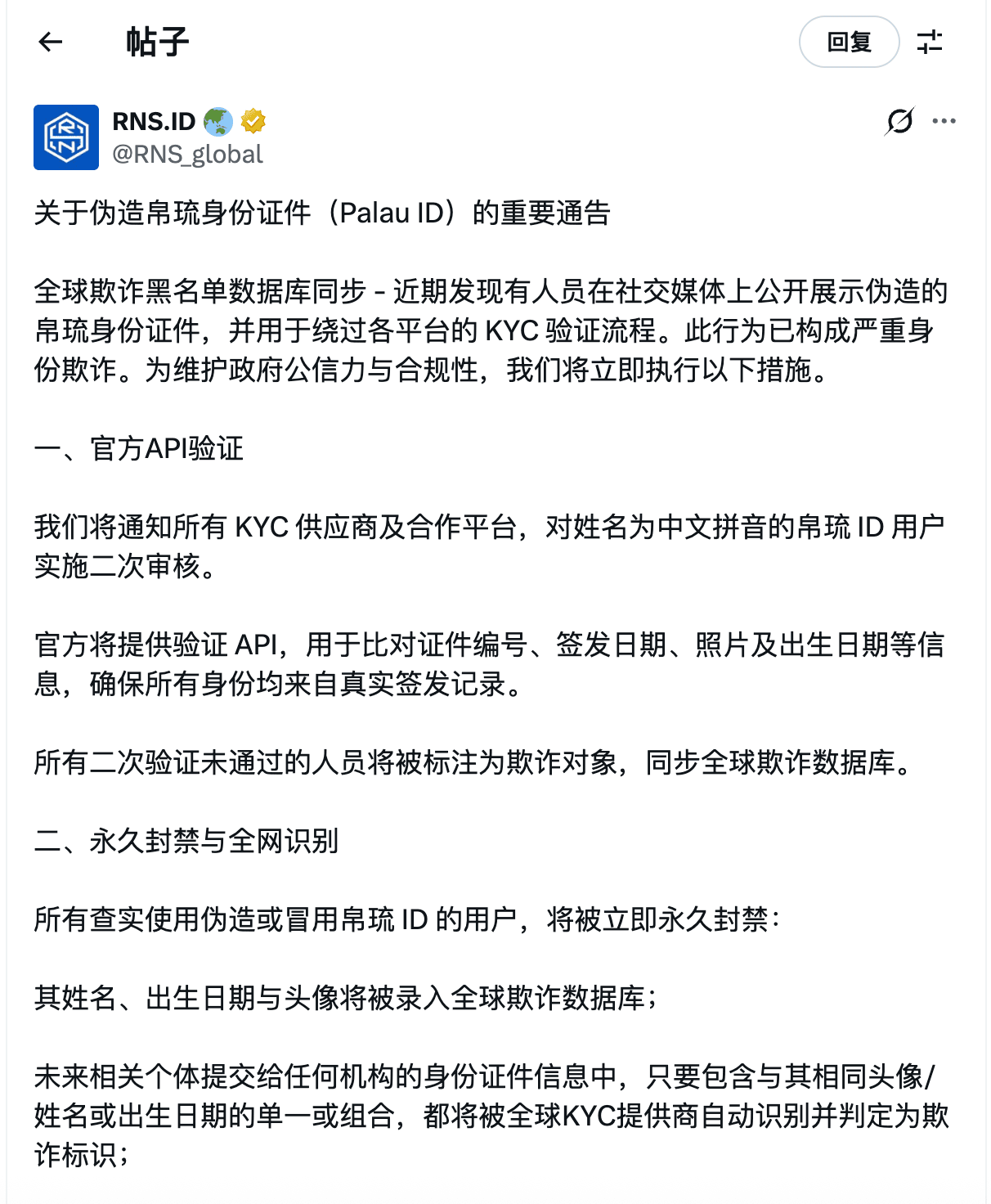

In October 2025, the official X account of the Republic of Palau Digital ID posted a rare announcement—in Chinese.

It warned that forged Palau ID documents were being openly displayed on social platforms and used to bypass KYC checks, constituting serious identity fraud. The RNS.ID authority announced secondary verification for all Palau IDs using Chinese pinyin; unverified users would be flagged as fraudulent and synced to a global fraud database.

Why would a Pacific island nation issue a notice in Chinese? The answer lies in Xianyu’s search results.

Search terms like “overseas identity” or “Palau ID” reveal an underground network selling fake documents, priced from tens to hundreds of yuan, promising “100% pass rate on major exchanges.”

Beyond Palau, IDs from Dominica, Nigeria, and the Philippines are also popular. Forgery quality has improved, with sellers offering customization using buyers’ real photos to pass facial recognition.

But beyond fake IDs for KYC, much of Xianyu’s crypto gray market revolves around zero-cost virtual services.

One account, “Shenzhen Xiaoxia,” once sold a 30-minute Binance/OKX download and setup tutorial for RMB 10 (now removed).

Xiaoxia is no anonymous seller. In crypto circles, the name is well known—a top-tier KOL. Not long ago, industry gossip circulated that he had gone RMB 60 million into debt to buy a luxury waterfront apartment in Shenzhen.

Why would a crypto millionaire personally sell RMB 10 “customer support” sessions on Xianyu?

Because the RMB 10 fee is just bait. The real money comes from referral commissions. Every user who registers via his link can generate ongoing trading-fee revenue—hundreds or even thousands of yuan per month per active user.

The RMB 10 product is a cheap fishing rod. On the other end is a scalable, renewable traffic pool.

If Xiaoxia’s model is an open play, many others profit from information asymmetry more directly.

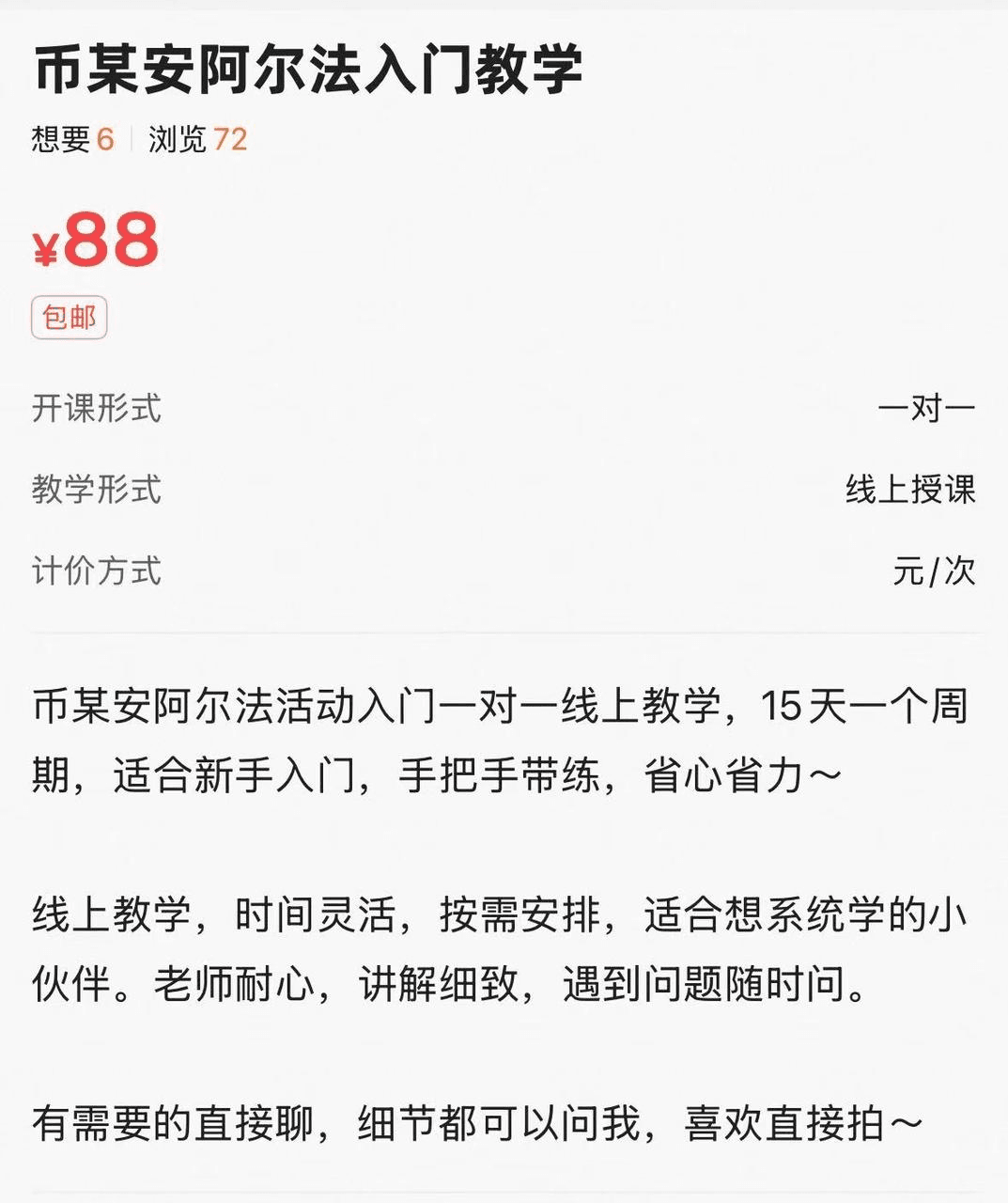

An RMB 88 “Binance Alpha beginner course” promises one-on-one coaching and “hands-on guidance.” “Alpha” typically refers to task-based programs by exchanges that offer potential airdrop rewards.

These methods are widely documented on X and YouTube—often for free. But for many domestic users, the combined barriers of language, network access, and information channels are real. As one buyer commented, “The seller was enthusiastic—much easier than figuring it out myself.”

The AI “Arms Depot”

If crypto trading is just a small darkroom in Xianyu’s folded space, AI commerce is a vast, mass-participation digital arms depot.

When ChatGPT and Claude took the world by storm, an invisible wall went up as well—complex registration, network constraints, and credit-card payments blocked most curious Chinese users. They could see the fireworks, but not the entrance.

Xianyu unexpectedly became the side path around the wall.

The “arms dealers” here offer full-stack services, from beginner to advanced.

The most basic product is an account—pre-registered GPT or Claude accounts sold for tens to hundreds of yuan, often with monthly top-up services.

Want to know which overseas AI tools are hottest? Check Xianyu.

In 2025, when Manus—later acquired by Meta for USD 2 billion—first launched, internal access codes were scarce. On Xianyu, prices jumped overnight from hundreds to thousands, even tens of thousands of yuan; at peak frenzy, listings reached RMB 100,000, helping Manus break into mainstream awareness.

Today, the hottest items are Gemini and ChatGPT.

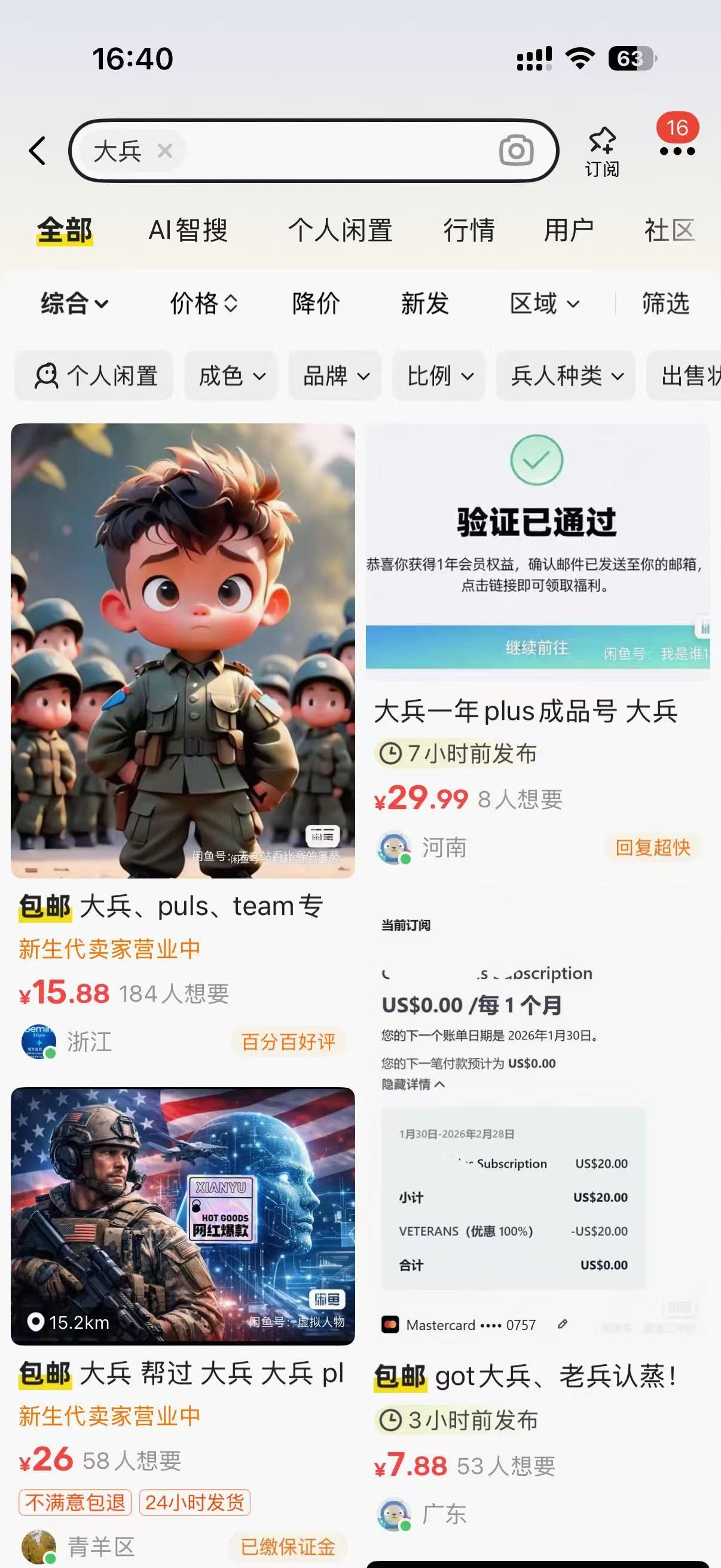

A USD 20 monthly subscription can deter many users. But Google offers students a free year, and OpenAI provides similar benefits to U.S. veterans. On Xianyu, sharp sellers turned this goodwill into a scaled business.

Search “soldier” (大兵), and a strange cyber scene appears: cartoon soldiers or tough-guy avatars, listings titled in shared slang—“Soldier approved,” “One-year Plus account”—priced from a few to dozens of yuan.

One user remarked:

“Xianyu is the largest AI training base in the Chinese-language world. Without it, most Chinese users wouldn’t have access to top-tier global AI models.”

Contradictory, yet painfully accurate.

A platform meant for second-hand goods has inadvertently become the gateway and diffuser of world-class AI in China.

Buying Everything

Crypto and AI are only the tip of the iceberg.

Some joke that “humans have developed less than 1% of Xianyu”—that it’s China’s version of the dark web.

Its “darkness” is less about crime than absurdity. Side hustles and underground services flourish, often becoming viral comedy.

Unpaid wages? One buyer hired “legal aid” on Xianyu—only to see 80 elderly women show up, crying and protesting. Wages paid within three days.

Need to refund a flight? Someone received a “death certificate.”

Xianyu is more than transactions; it may be the most authentic ethnographic field of the Chinese internet.

Wild ingenuity thrives here. It ignores corporate elegance and worships one principle only: problem-solving. When official channels fail or cost too much, grassroots creativity erupts—raw, and often darkly humorous.

The digital black market reflects a real slice of contemporary China: no glossy branding, just human impulses—speculation, shortcuts, laziness, desperation, and survival between the cracks of rules.

But when “solutions” drift deeper into gray zones, the traded object eventually becomes the person.

If hiring elderly women is renting others’ performance, the most dangerous trade is renting your own identity.

“New users wanted for exchanges,” “buying KYC-verified accounts,” “long-term recruitment for QR registrations”—these listings openly package a person’s digital KYC identity for sale. Sellers frame it as “being a landlord in the digital age,” making users believe they’re monetizing idle assets.

In reality, those accounts can become tools for fraud or money laundering.

From buying tutorials, to buying accounts; from outsourcing trouble, to becoming part of it—this bizarre chain closes into a frightening loop.

We start by paying for convenience, and end by trading ourselves for money.

This chaotic digital soil is both grassroots infrastructure—helping ordinary people bypass barriers—and a dark forest full of traps. It proves, in extreme form, that suppressed demand never disappears; it only resurfaces where rules cannot reach, in cruder and riskier ways.

Here, convenience and cost share the same price tag. You think you’re taking a shortcut—only to realize the shortcut may end at a cliff.

You may also like

HYPE Price Target Achieves $50 as Hyperliquid Reduces Team Token Unlock by 90% — Assessing The Rally’s Longevity

Key Takeaways Hyperliquid significantly cut its monthly token unlocks by 90%, sparking renewed interest in its HYPE token’s…

Hong Kong-Based OSL Group Launches $200M Equity Raise for Stablecoin and Payments Expansion

Key Takeaways OSL Group, a prominent digital asset platform in Asia, has initiated a significant $200 million equity…

Gold Price Prediction: Current Trends and Future Outlook for January 28, 2026

Key Takeaways Gold and silver prices play a significant role in the global economy, reflecting both market trends…

GameStop 2.0? Why Robinhood’s CEO Advocates Tokenization for Trading Halts

Key Takeaways Tokenized stocks are seen as a solution to counteract the disruptions seen in traditional equity markets…

Central Bank of the UAE Endorses First USD-Backed Stablecoin

Key Takeaways The UAE Central Bank has endorsed the first US dollar-backed stablecoin, USDU, to streamline compliant settlements…

Can the Gold Price Rise to $6,000?

Key Takeaways Gold prices in 2026 have experienced dramatic surges, reaching unprecedented levels in just the first month…

Solana Loses Major Portion of Validators as Smaller Nodes Exit: Concerns Over Centralization

Key Takeaways: Solana has experienced a significant drop in active validators from a high of 2,560 in March…

Gold Price Prediction as Tom Lee Says Metals Rally Could Hit Crypto

Key Takeaways: Gold recently reached an all-time high of $5,598, reflecting a strong investor shift towards safe-haven assets…

Bitcoin’s Historical Bottom Indicator Points to $62K – Could BTC Fall That Low?

Key Takeaways Bitcoin is nearing a critical support level of \$62,000, with key indicators suggesting potential further declines.…

Talos Raises $45M Series B Extension Backed by Robinhood, Bringing Total Funding to $150M

Key Takeaways: Talos, a leading provider of institutional digital asset trading technology, has raised $45 million in a…

What is the Next Milestone for Gold Prices and Will It Reach $6,000 by Year End?

Key Takeaways: Gold prices recently crossed the $5,000 per ounce mark, spurring predictions of further increases amidst global…

Bitcoin Price Prediction: Binance Inflows Just Hit a 4-Year Low – Violent Move Above $100K is Next

Key Takeaways: Bitcoin inflows into Binance have dropped to their lowest in four years, potentially signaling a tight…

Gold to $10,000 and Silver to $150: My Wild, Or Perhaps Not-So-Wild 2026 Price Predictions

Key Takeaways Geopolitical uncertainties are significantly driving up the demand for gold and silver, suggesting the prices may…

Hong Kong Enhances Gold Market Access Through Hang Seng Gold ETF and Tokenized Units

Key Takeaways: The Hang Seng Gold ETF offers Hong Kong investors direct access to gold by launching a…

XRP “Millionaire” Wallets Rise Despite Modest Price Dip: Santiment

Key Takeaways: The count of XRP wallets holding over 1 million tokens is increasing, despite a slight dip…

Russia Caps Crypto Investments at $4,000 Annually for Non-Qualified Investors – Will Others Follow Suit?

Key Takeaways Russia’s proposal sets a $4,000 annual investment limit for non-qualified crypto investors, sparking discussions on regulatory…

Japan’s Metaplanet Announces $137 Million Capital Raise Via Third-Party Allotment

Key Takeaways Japanese firm Metaplanet Inc. has strategized a $137 million capital raising through the third-party allotment of…

Crypto Price Prediction for January 28 – XRP, Solana, Bitcoin

Key Takeaways Bitcoin price recently hit $90,000 but struggled to maintain this peak. XRP and Solana are following…

HYPE Price Target Achieves $50 as Hyperliquid Reduces Team Token Unlock by 90% — Assessing The Rally’s Longevity

Key Takeaways Hyperliquid significantly cut its monthly token unlocks by 90%, sparking renewed interest in its HYPE token’s…

Hong Kong-Based OSL Group Launches $200M Equity Raise for Stablecoin and Payments Expansion

Key Takeaways OSL Group, a prominent digital asset platform in Asia, has initiated a significant $200 million equity…

Gold Price Prediction: Current Trends and Future Outlook for January 28, 2026

Key Takeaways Gold and silver prices play a significant role in the global economy, reflecting both market trends…

GameStop 2.0? Why Robinhood’s CEO Advocates Tokenization for Trading Halts

Key Takeaways Tokenized stocks are seen as a solution to counteract the disruptions seen in traditional equity markets…

Central Bank of the UAE Endorses First USD-Backed Stablecoin

Key Takeaways The UAE Central Bank has endorsed the first US dollar-backed stablecoin, USDU, to streamline compliant settlements…

Can the Gold Price Rise to $6,000?

Key Takeaways Gold prices in 2026 have experienced dramatic surges, reaching unprecedented levels in just the first month…