8 Shitcoin ETFs Entry Record: Only $700 Million Raised, Unable to Stop Price Decline

Original Article Title: "Observation of Four Major Altcoin ETFs Listing: Total Inflow of $700 Million, Issuance Easy but Difficulty in Attracting Funds"

Original Author: Nancy, PANews

As the US SEC opens a fast track for crypto ETFs and the regulatory environment becomes increasingly clear, more and more altcoins are attempting to step onto the Wall Street stage. Since last month, 8 altcoin ETFs have been approved one after another, but in the overall bearish crypto market environment, these products are generally facing the problem of limited fund inflow after listing, making it difficult to significantly boost the coin prices in the short term.

Four Major Altcoins Landing on Wall Street, Limited Short-Term Fundraising Capability

Currently, four crypto projects, Solana, Ripple, Litecoin, and Hedera, have obtained the "ticket" to Wall Street. However, from the perspective of fund flows, the overall attractiveness is still limited, and some ETFs have experienced zero inflows for multiple days. These four types of ETFs have only received a cumulative net inflow of approximately $700 million. Additionally, after the ETFs were launched, the prices of the respective coins have generally declined, which is also partly influenced by the overall crypto market pullback.

• Solana

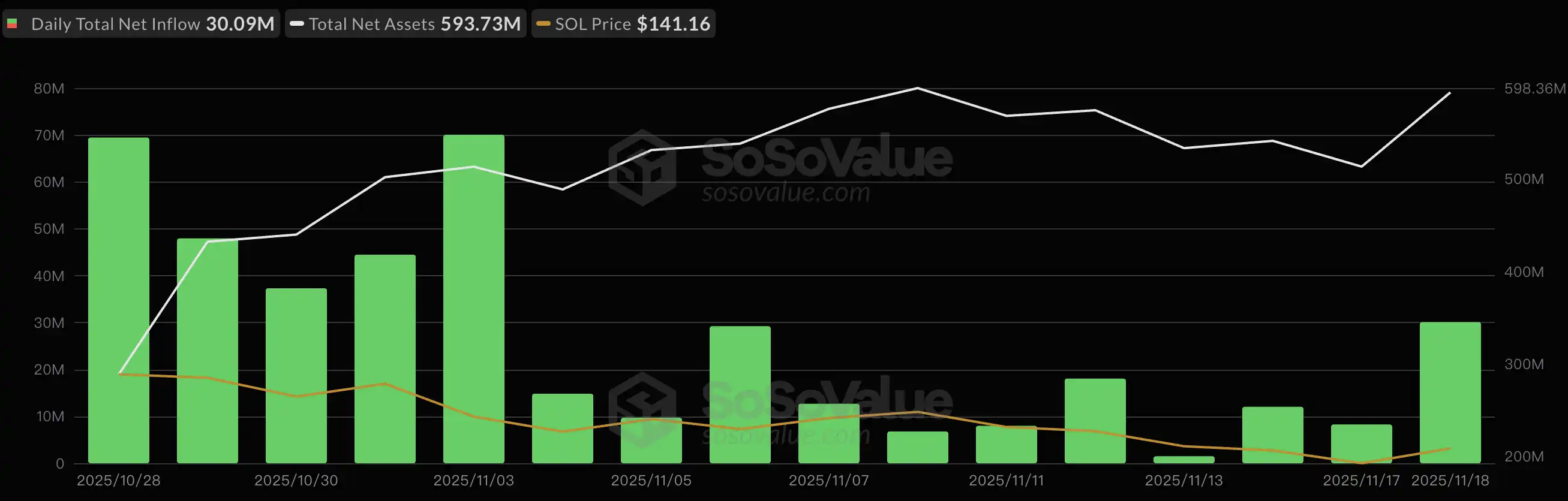

Currently, there are five US Solana spot ETFs on the market, issued by Bitwise, VanEck, Fidelity, Grayscale, and Canary, with related products from 21Shares and CoinShares also in the pipeline.

According to SoSoValue data, the cumulative total net inflow of US Solana spot ETFs is approximately $420 million, with a total net asset value of $594 million. Among them, Bitwise's BSOL contributed the main trading volume, with a total of $388 million in net inflow over three weeks, but most of it came from an initial investment of nearly $230 million on the first day, after which the inflow slowed significantly. Fidelity's FSOL had a net inflow of only $2.07 million on the first day of listing on November 18, with a total net asset value of $5.38 million; Grayscale's GSOL had a cumulative net inflow of approximately $28.45 million, with a total net asset value of $99.97 million; Canary's SOLC had no net inflow on the first day of listing, with a total net asset value of $0.82 million. It is worth noting that the ETF issuers all support staking, which may provide some support for market demand.

CoinGecko data shows that since the first Solana spot ETF went live on October 28, the price of SOL has dropped by 31.34% to date.

• XRP

Regarding the U.S. XRP spot ETF, the only product currently listed is XRPC launched by Canary. Related products from CoinShares, WisdomTree, Bitwise, and 21Shares are still in the preparation stage.

According to SoSoValue data, since its launch, XRPC has seen a cumulative net inflow of over $270 million. The first-day trading volume reached $59.22 million but did not generate net inflows. The next day, net inflows of $243 million were achieved through cash or in-kind purchases, with a trading volume of $26.72 million.

CoinGecko data shows that since the first Ripple spot ETF was listed on November 13, the XRP price has dropped by approximately 12.71%.

• LTC

At the end of October this year, Canary Capital officially launched the first U.S. ETF tracking Litecoin, LTCC. Related products from CoinShares and Grayscale are still in the preparation stage and are expected to follow suit.

According to SoSoValue data, as of November 18, LTCC has seen a cumulative net inflow of approximately $7.26 million. Daily net inflows are generally only in the hundreds of thousands of dollars, with several days experiencing zero inflows.

CoinGecko data shows that since the first Litecoin spot ETF was listed on October 28, the LTC price has dropped by about 7.4%.

• HBAR

The first U.S. ETF tracking HBAR, HBR, was also launched by Canary Capital at the end of last month. According to SoSoValue data, as of November 18, HBR has seen a cumulative net inflow of approximately $74.71 million. Nearly 60% of the funds were concentrated in the first week of inflows, after which net inflows decreased significantly, with some days even experiencing consecutive days of zero inflows.

CoinGecko data shows that since the first Hedera spot ETF was listed on October 28, the HBAR price has dropped by approximately 25.84%.

In addition to the above projects, upcoming spot ETFs for assets such as DOGE, ADA, INJ, AVAX, BONK, and LINK are still in progress. Bloomberg analyst Eric Balchunas expects Grayscale's Dogecoin ETF to be launched on November 24.

Crypto ETF Expansion Cycle Initiated, Listing Performance Still Faces Multiple Challenges

According to Bloomberg's incomplete statistics, the crypto market currently has 155 ETP (Exchange-Traded Product) applications, covering 35 digital assets, including Bitcoin, Ethereum, Solana, XRP, and LTC, presenting a beachhead-style growth trend. With the end of the U.S. government shutdown, the approval process for these ETFs is expected to accelerate.

As the U.S. regulatory environment gradually clarifies, it may propel a new round of expansion for crypto ETF applications. The U.S. SEC has approved general listing standards for crypto ETFs and recently released new guidance allowing ETF issuers to expedite the effectiveness of their registration statements. Meanwhile, in its latest annual examination priorities document, the U.S. SEC significantly removed the previously routine cryptocurrency-specific section. This is in contrast to the era of former chair Gary Gensler when cryptocurrencies were explicitly included as an examination priority, specifically mentioning spot Bitcoin and Ethereum ETFs.

Furthermore, the introduction of staking is believed to stimulate institutional investor demand, thus attracting more issuers to join the ETF application queue. Research from Swiss crypto bank Sygnum shows that despite the recent market downturn, institutional investor confidence in crypto assets remains strong. Over 80% of institutions express interest in crypto ETFs beyond Bitcoin and Ethereum, with 70% stating that if an ETF can offer staking rewards, they would begin or increase their investments. On the policy front, there has also been a positive signal for ETF staking. Recently, U.S. Treasury Secretary Scott Bessent issued a new statement saying they will collaborate with the IRS to update guidance to provide regulatory support for crypto ETPs that include staking capabilities. This move is considered likely to expedite the approval time for Ethereum staking ETPs and pave the way for multi-chain staking products on networks such as Solana, Avalanche, and Cosmos.

However, altcoin ETFs currently lack sufficient funding attractiveness, mainly due to factors such as market size, liquidity, volatility, and market sentiment.

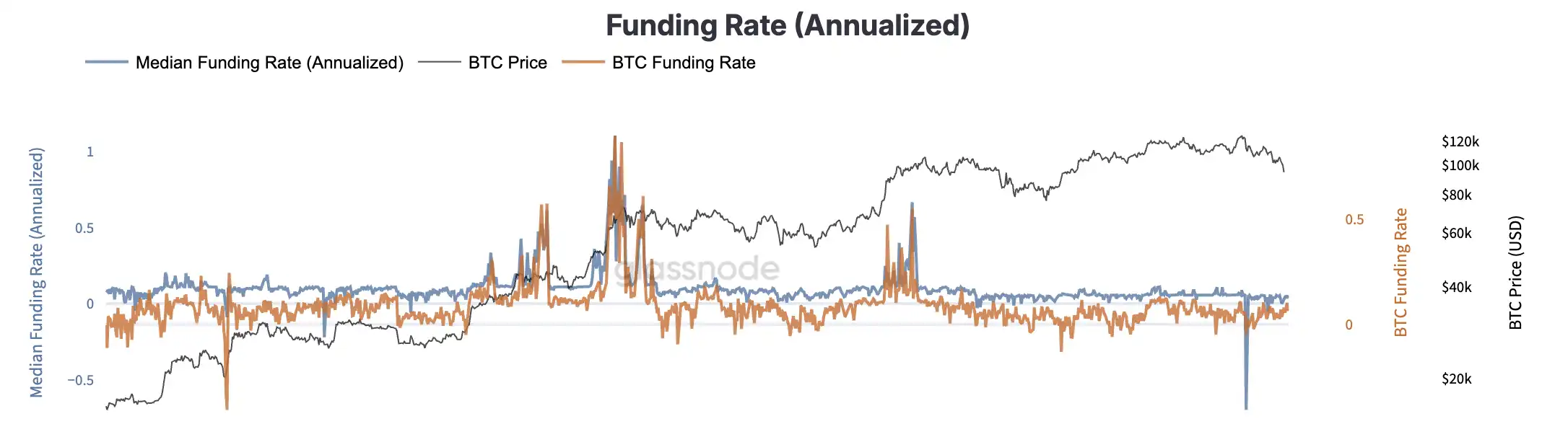

On one hand, altcoins have limited market size and liquidity. According to CoinGecko data as of November 18, Bitcoin's market dominance is close to sixty percent, and after excluding ETH and stablecoins, the market share of other altcoins is only 19.88%. This makes the underlying asset liquidity of altcoin ETFs relatively poor. Additionally, compared to Bitcoin and Ethereum, altcoins are susceptible to short-term narratives, have higher volatility, and are seen as high-risk beta assets. Based on Glassnode data, since the beginning of this year, relative altcoin profits have mostly fallen to deep plunge levels, leading to a significant divergence between Bitcoin and altcoins not commonly seen in previous cycles. Thus, altcoin ETFs struggle to attract investors on a large scale, especially single-asset ETFs. In the future, investors may be more inclined to adopt diversified, decentralized basket altcoin ETF strategies to reduce risk and enhance potential returns.

On the other hand, meme coins face market manipulation and transparency risks. Many meme coins have low liquidity, making them susceptible to price manipulation. The net asset value (NAV) of an ETF relies on the underlying asset price, so if a meme coin's price is manipulated, it directly affects the ETF's value, potentially triggering legal risks or regulatory scrutiny. Additionally, some meme coins may be deemed unregistered securities. Currently, the SEC is advancing a token taxonomy plan to differentiate whether a cryptocurrency qualifies as a security.

Furthermore, the uncertainty in the macroeconomic environment has exacerbated investors' risk aversion sentiment. In a situation of overall low confidence, investors tend to prefer allocating to traditional assets like US stocks and gold. Meanwhile, meme coin ETFs lack the recognition and market acceptance enjoyed by Bitcoin or Ethereum spot ETFs, especially lacking endorsement from major institutions like BlackRock. The distribution network, brand effect, and market trust brought by the top issuers are hard to replicate, further weakening the meme coin ETFs' attractiveness in the current environment.

You may also like

BankrCoin Achieves New Milestones as YZi Labs and ETH Investors Make Significant Moves

Key Takeaways BankrCoin (BNKR) hit a new all-time high with significant market activity. YZi Labs executed a major…

Bitcoin Tests $75K Amid Market Predictions

Key Takeaways Bitcoin shows a 47% chance to test the $75,000 mark this February, contrasting with a potential…

MrBeast Acquires Step to Enhance Financial Offerings for Youth

Key Takeaways YouTube star MrBeast has acquired the financial services platform Step through Beast Industries. The acquisition aims…

Polymarket Predicts Bitcoin Uptrend as MrBeast Ventures into Fintech

Key Takeaways Bitcoin’s Potential Surge: Polymarket denotes a fluctuating probability of Bitcoin achieving $75,000 in February, reflecting volatile…

MrBeast Enters Financial Services with Step Acquisition

Key Takeaways Binance announced an Alpha Airdrop event, highlighting the growing trend of gamified airdrops. Bitcoin prediction markets…

Analysts Predict Bitcoin May Fall to $55K as Support Levels Threaten

Key Takeaways Analysts suggest a potential drop of Bitcoin to $55K if current support levels are breached. Galaxy…

Analysts Predict Bitcoin May Drop to $55K Amid Support Challenges

Key Takeaways Experts caution that Bitcoin could fall to $55,000 if current support levels are breached. The market…

Bitcoin May Decline to $55K: Analysts Warn

Key Takeaways Analysts project Bitcoin could drop to $55,000 if key support levels fail. Technical analysts forecast that…

YZI Labs Transfers Massive ID Tokens to Binance as BNKR Hits New High

Key Takeaways BNKR, a digital currency, has achieved its highest-priced milestone of $0.295 CAD as of January 26,…

MrBeast Acquires Step, Expanding Influence in Teen Finance Market

Key Takeaways MrBeast has acquired the financial services app Step, which caters specifically to Gen Z users. Step…

Analysts Predict Bitcoin’s Critical Support Level May Trigger Decline

Key Takeaways Experts indicate a crucial moment for Bitcoin, with potential price drop to $55,000 if support fails.…

Michael Saylor Faces Bitcoin Valuation Challenges: Impact on the Crypto Market

Key Takeaways Michael Saylor’s Bitcoin investment is currently valued at $55 billion, but recent market trends have seen…

MrBeast Acquires Step FinTech App in Strategic Move

Key Takeaways MrBeast’s company, Beast Industries, has announced the acquisition of Step, a fintech app focused on Gen…

Bitcoin’s Potential Surge Sparks Debate Among Investors

Key Takeaways The probability that Bitcoin will reach $75,000 in February fluctuates as predicted by Polymarket. Bitcoin recently…

Analysts Predict Bitcoin’s Potential Plunge to $55K

Key Takeaways Analysts warn of a possible drop to $55K if Bitcoin’s current support breaks. 10X Research and…

Bitcoin’s Critical Threshold: The Significance of $55,000 USD

Key Takeaways Bitcoin’s value is set to rise from $55,000 to $99,000 if it maintains a growth cycle…

Analysts Predict Bitcoin Drop to $55K as Support Wavers

Key Takeaways Analysts caution that Bitcoin’s price could plummet to $55K if current support levels fail. Galaxy Digital’s…

MrBeast Acquires Step, Expanding Fintech Influence

Key Takeaways MrBeast’s company, Beast Industries, has acquired the Gen Z-focused fintech app Step, which targets teens with…

BankrCoin Achieves New Milestones as YZi Labs and ETH Investors Make Significant Moves

Key Takeaways BankrCoin (BNKR) hit a new all-time high with significant market activity. YZi Labs executed a major…

Bitcoin Tests $75K Amid Market Predictions

Key Takeaways Bitcoin shows a 47% chance to test the $75,000 mark this February, contrasting with a potential…

MrBeast Acquires Step to Enhance Financial Offerings for Youth

Key Takeaways YouTube star MrBeast has acquired the financial services platform Step through Beast Industries. The acquisition aims…

Polymarket Predicts Bitcoin Uptrend as MrBeast Ventures into Fintech

Key Takeaways Bitcoin’s Potential Surge: Polymarket denotes a fluctuating probability of Bitcoin achieving $75,000 in February, reflecting volatile…

MrBeast Enters Financial Services with Step Acquisition

Key Takeaways Binance announced an Alpha Airdrop event, highlighting the growing trend of gamified airdrops. Bitcoin prediction markets…

Analysts Predict Bitcoin May Fall to $55K as Support Levels Threaten

Key Takeaways Analysts suggest a potential drop of Bitcoin to $55K if current support levels are breached. Galaxy…