$5 Million Stolen Funds Blocked, Privacy Mixer Railgun Turns Into DeFi Protocol "Clawback Tool"?

Hacker's Loot, Can Actually Be Forced to Return?

On February 12, the zkLend lending protocol on Starknet was hacked, losing nearly $5 million. However, the hacker did not expect that after mixing the money into Railgun, the final step before whitewashing could be immediately blocked by Railgun's protocol policy, forcing a return.

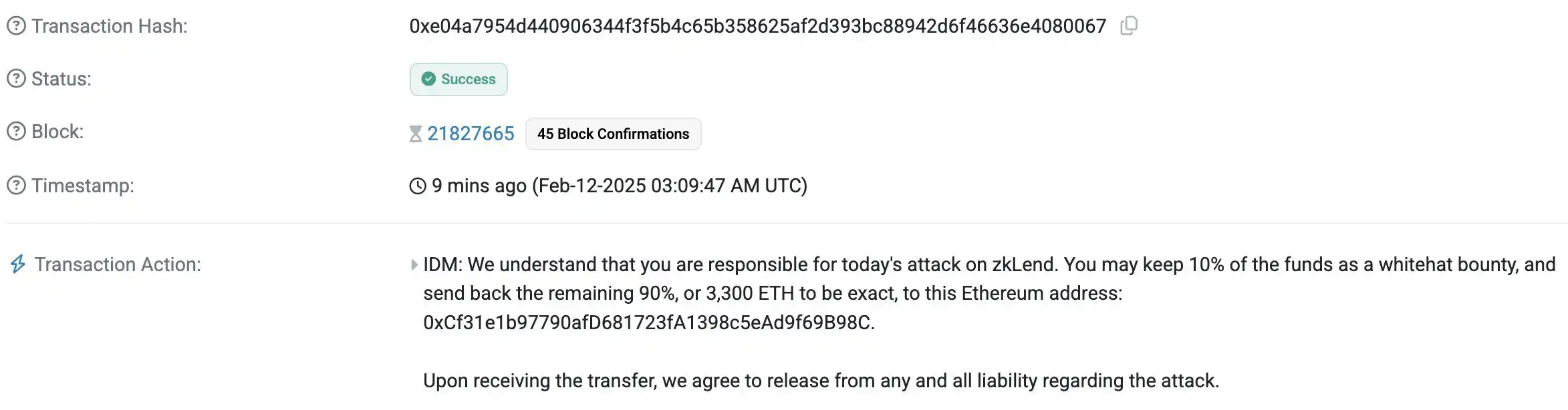

After the incident, zkLend suspended withdrawal services to safeguard the remaining funds and posted a message to the community stating that the team is actively working with multiple partners to track the hacker's identity and fund flow, promising transparency, and eventually will release a detailed investigation analysis report. In addition, zkLend also proposed to the hacker that they could keep 10% of the funds as a white hat bounty, with the remaining 90% (3,300 ETH) being transferred back to zkLend's Ethereum address. Upon receiving the transfer, the hacker would agree to waive any and all liability related to the attack.

As of the time of writing, there has been no response from the hacker regarding this proposal. zkLend posted on social media that they have reported the incident to the Hong Kong Police, the FBI, and the Department of Homeland Security and will initiate legal proceedings.

On February 13, Ethereum co-founder Vitalik, who has always supported Railgun, posted on social media, specifically explaining how Railgun successfully avoided dealing with criminal proceeds this time.

After Vitalik's post, the market's response to this news was very sensitive, and Railgun surged. According to market data, as of the time of writing, Railgun has seen a 7.00% increase in the past 24 hours, with trading volume up 162.31%.

On-Chain Anti-Money Laundering, How Does Railgun Do It?

Speaking of Railgun, this clearly anti-money laundering policy protocol, we have to mention the leading mixer service project, Tornado Cash.

Tornado Cash and Railgun both belong to the privacy track and are the first projects to provide mixer services. Its privacy protection features have made it a tool for hackers and criminals to launder money and hide funds, attracting the attention of governments and regulatory agencies worldwide, especially the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC) sanctions against it.

In August 2022, the U.S. Department of the Treasury imposed sanctions on Tornado Cash, stating that the service had facilitated money laundering of over $7 billion in the past three years and assisted the North Korean state-sponsored hacker group Lazarus Group in evading U.S. sanctions. In May 2024, one of the founders of Tornado Cash and core developer, Alexey Pertsev, was sentenced to 5 years and 4 months in prison.

Read more: "Guilty Verdict! What Does the Tornado Cash Case Judgment Mean for DeFi Regulation?"

Tornado Cash, due to its lack of anti-money laundering capabilities, became a convenient tool for hackers and money laundering criminals. The regulatory crackdown sounded an alarm for the entire privacy track. Learning from the lessons of Tornado Cash, Railgun, as a frontrunner in the privacy track, naturally had to learn from it and had a clear direction for improvement: anti-money laundering.

Railgun has adopted a more rigorous anti-money laundering strategy, focusing on enhancing compliance while maintaining privacy. The core of this strategy is to ensure that the platform can protect user privacy while effectively meeting regulatory requirements and preventing funds from being used for illicit activities. The following are the specific measures Railgun has taken:

The first step, Railgun did not solely focus on optimizing the code but cleverly compiled a blacklist from regulators, compliance platforms, and other sources. The blacklist covers transaction data related to illegal activities such as money laundering, fraud, and sanctions violations, providing specific targets for precise enforcement.

The second step, after any user makes a deposit, there is a 1-hour detection period during which various algorithms analyze whether the deposit may be related to the blacklist. The entire process is fully encrypted, only outputting a conclusion of "association" or "non-association," without revealing sensitive information such as user addresses, transaction history, or balances, ensuring user privacy is technically protected.

The third step, one hour later, the user can utilize zero-knowledge proofs (ZKPs) for private withdrawals. Additionally, Railgun's internal protocol policy stipulates that if a suspicious address attempts to mix coins, the funds from that suspicious address will be forcibly returned.

Finally, Railgun proactively complies. All proofs generated by user wallets can be provided to exchanges or regulatory agencies, and these third-party entities can verify proof validity through validation algorithms without accessing user fund flows, wallet activity details, or identity data. This mechanism meets external organizations' scrutiny requirements for transaction compliance while completely avoiding the risk of user privacy leaks, achieving "trustless self-attestation."

It is precisely this combination of privacy protection, compliance mechanisms, and risk control strategies that formed the final line of defense in intercepting money laundering attackers in the zkLend incident.

The founder of Slowmist also stated, "This is a very good privacy solution."

Privacy Track, Where to Go Next?

While Railgun is building a regulatory moat, regulatory policies in the United States seem to be easing.

On November 27 last year, the U.S. Fifth Circuit Court of Appeals ruled that the U.S. Treasury Department's sanction on the Tornado Cash smart contract was illegal. For the cryptocurrency community and all who care about defending freedom, this was a historic victory. The founder of Uniswap referred to it as "an immutable smart contract beating the Treasury Department in court."

Will this ruling breed more and more calls in the privacy track for "code is law" while actually fostering criminal projects?

Related Reading: "Comprehensive Analysis of the Privacy Track: Defending Privacy or Fostering Crime, the Revolution Is Not Yet Successful"

Regardless, in the current environment of increasingly clear cryptocurrency regulations post-Trump administration, Railgun, which combines privacy and compliance, should set an example for the development of this track.

You may also like

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…

South Korea Utilizes AI to Pursue Unfair Crypto Trading: Offenders Face Severe Penalties

Key Takeaways South Korea is intensifying its use of AI to crack down on unfair cryptocurrency trading practices.…

Average Bitcoin ETF Investor Turns Underwater After Major Outflows

Key Takeaways: U.S. spot Bitcoin ETFs hold approximately $113 billion in assets, equivalent to around 1.28 million BTC.…

Japan’s Biggest Wealth Manager Adjusts Crypto Strategy After Q3 Setbacks

Key Takeaways Nomura Holdings, Japan’s leading wealth management firm, scales back its crypto involvement following significant third-quarter losses.…

CFTC Regulatory Shift Could Unlock New Opportunities for Coinbase Prediction Markets

Key Takeaways: The U.S. Commodity Futures Trading Commission (CFTC) is focusing on clearer regulations for crypto-linked prediction markets,…

Hong Kong Set to Approve First Stablecoin Licenses in March — Who’s In?

Key Takeaways Hong Kong’s financial regulator, the Hong Kong Monetary Authority (HKMA), is on the verge of approving…

BitRiver Founder and CEO Igor Runets Detained Over Tax Evasion Charges

Key Takeaways: Russian authorities have detained Igor Runets, CEO of BitRiver, on allegations of tax evasion. Runets is…

Crypto Investment Products Struggle with $1.7B Outflows Amid Market Turmoil

Key Takeaways: The recent $1.7 billion outflow in the crypto investment sector represents a second consecutive week of…

Why Is Crypto Down Today? – February 2, 2026

Key Takeaways: The crypto market has seen a downturn today, with a significant decrease of 2.9% in the…

Nevada Court Temporarily Bars Polymarket From Offering Contracts in the State

Key Takeaways A Nevada state court has temporarily restrained Polymarket from offering event contracts in the state, citing…

Bitcoin Falls Below $80K As Warsh Named Fed Chair, Triggers $2.5B Liquidation

Key Takeaways Bitcoin’s price tumbled below the crucial $80,000 mark following the announcement of Kevin Warsh as the…

Strategy’s Bitcoin Holdings Face $900M in Losses as BTC Slips Below $76K

Key Takeaways Strategy Inc., led by Michael Saylor, faces over $900 million in unrealized losses as Bitcoin price…

Trump-Linked Crypto Company Secures $500M UAE Investment, Sparking Conflict Concerns

Key Takeaways A Trump-affiliated crypto company, World Liberty Financial, has garnered $500 million from UAE investors, igniting conflict…

Billionaire Michael Saylor’s Strategy Buys $75M of More Bitcoin – Bullish Signal?

Key Takeaways Michael Saylor’s firm, Strategy, has significantly increased its Bitcoin holdings by acquiring an additional 855 BTC…

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…

South Korea Utilizes AI to Pursue Unfair Crypto Trading: Offenders Face Severe Penalties

Key Takeaways South Korea is intensifying its use of AI to crack down on unfair cryptocurrency trading practices.…